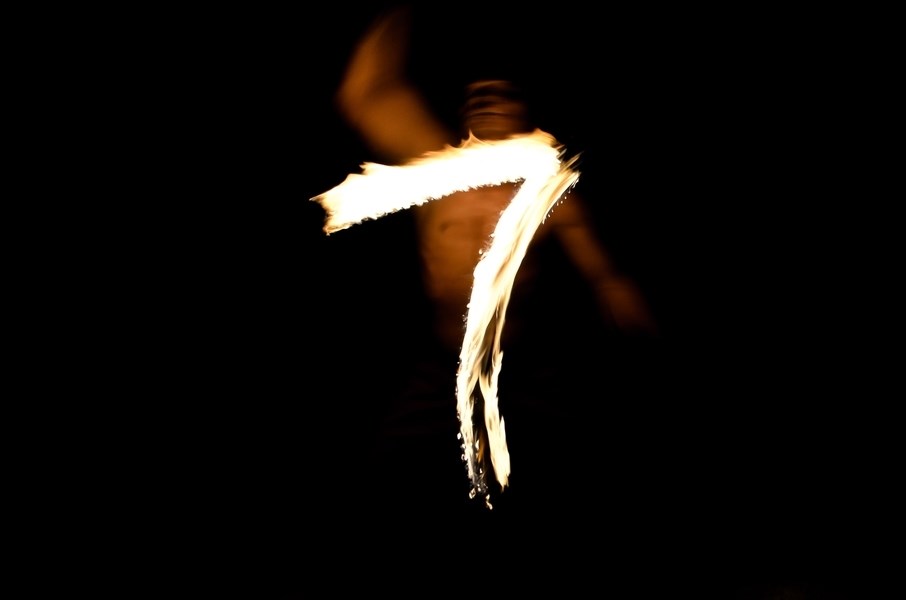

The 7 Deadly Sins of Credit Management

Despite increased attention to the slow, or “late” payments crisis, a staggering 83% of small suppliers, and 89% of Public Sector Suppliers in the UK are still experiencing late payments. Slow payments are destroying SME suppliers, hurting large buyers, and ultimately holding back our Economic Growth.

A recent survey of over 1000 SME’s concluded that small businesses are finally hitting back against late payers. 22% have blacklisted such customers, 39% enforce a late payment fee and nearly a quarter, 24% have sought County Court Judgements with a third, 35% resorting to a Debt Collection Agency, or alternative low-cost cash recovery service. Staff too pay the price for late payments, 36% of companies have had to delay salary payments, stopped or delayed bonuses, and nearly 10% have ceased staff perks-mobile phones, private health care and company cars etc. 29% claim staff morale, recruitment and retention have been affected. Despite these sacrifices 18% of those surveyed were on the brink of bankruptcy or liquidation and 42% had been forced to take out a business loan to cover shortfalls. 29% struggle to pay business rates, 21% the monthly office rent or mortgage and 18% had been refused a company loan due to a poor credit score. Nearly a third of business owners are sacrificing their salary as a result and 29% suffer depression, anxiety, stress and mental health issues.

Late Payments - a leading cause of small business bankruptcy

Slow payments caused by lengthy payment terms are one of the leading causes of small business bankruptcy in the UK. Last year 50,000 SME’s went bust as a direct result of late payments. These late payments cost the UK Economy £2.5Bln a year, and 30% of all invoices are paid late. The impact is not only felt by SME’s, it adds unnecessary costs to the chain as suppliers factor in the cost of carry, and therefore affects both suppliers and buyers bottom lines. Suppliers endure long periods from 30 days to 180 days plus waiting to get paid, often forcing them to turn to expensive credit to balance their cashflow, and when you add in the hidden costs of time and resources spent chasing invoices, the cost of business increases substantially leading to higher prices for buyers-and ultimately us. This is a global problem, slow B2B payments lose the worlds businesses $650Bln a year, a staggering amount of money and a very wasteful way to do business.

Late payments can be avoided by suppliers by strengthening their defences when taking on new clients, or continuing to trade with existing customers. Often delayed invoice payments are a direct result of the supplier being lax during the procurement process. I call these the “7 Deadly Sins of Credit Management” (listed below) and more often than not if these are all ring-fenced your invoicing and payments should run smoothly, without the need to employ a collections agency.

1. Not knowing exactly who you are dealing with

You cannot hope to successfully collect owed monies if you don't know the exact legal entity of the debtor you are dealing with. Is it Fred Bloggs, or Fred Bloggs UK Ltd, or even Fred and Joe Bloggs trading as Fred Bloggs? Fail to determine exactly who it was, and you're unlikely to win in a legal case.

2. Terms and Conditions absent or lacking detail

Many SME’s have inadequate or sometimes even no T&C’s. This is fine if its all going well, but qualified T&C’s are crucial if a relationship turns sour or a customer queries an order or invoice. Basic T&C’s are an integral part of your business when offering credit to other businesses. Companies often skimp on watertight T&C’s for the sake of saving a few hundred pounds with a solicitor

3. Sloppy paperwork and lax admin

Lax administration means you are not going to get paid on time-sometimes not at all. Common examples are: Setting up customer details incorrectly, names, addresses etc; failing to quote order numbers on invoices; Unsigned proof of deliveries (or time sheets); Failure to make clear and get specific agreement to your credit terms. The devil is in the detail – when did you last check an order received from a regular customer was from the exact entity set up on your accounting records. Your credit dealings and limits should always be with the company within the group that’s financially able to pay out when financial problems occur, don’t become the fall guy who doesn’t get paid by supplying a lesser established company within a larger company.

4. Complacency - they have always paid before

“Its fine, relax, they always pay” the words of comfort often uttered by suppliers when facing an unpaid invoice from a regular customer for the first time. This can be the most challenging sin to address – you feel awkward, they feel they’ve earned your trust – and the right to ongoing credit, no questions asked. Whatever you do, do not extend/give more credit no matter what the relationship, its not a justifiable reason for ignoring the warning signs coming your way.

You need to monitor your customer’s, how often do you have to chase them? Do they pay when they say they will? Use a credit report monitoring service, these alert you to meaningful changes in the credit status of your customers. Beware though, this is not failsafe and is often based on outdated information such as that held at Companies House which is often over 12 months old. Sadly, often when you discover that a customer has a new CCJ against them it will be too late for you to get your outstanding invoices paid.

Be a realist when assessing how important you are on your customers priority list for payment – are you replaceable or irreplaceable in their supply chain? For example a printing company starts experiencing financial difficulties, they’re holding on grimly though, and in the distant future hope to secure a fortune reversing major order. Which suppliers have a good warning that the printers maybe in trouble? The Paper Merchants? Oblivious, without paper there’s no product. The Ink Suppliers? Oblivious, no ink-no print. Water and Electricity? No, both essential utilities. So all these suppliers are oblivious to the true financial situation of the printers, it’s the non-essential and easily replaceable suppliers who will find out first, perhaps their couriers, or delivery service, or their stationery supplier, all easy to replace and with a queue of companies all waiting to step up to the plate. Will they ever get paid? Perhaps if they’ve gathered the correct information about the printer.

You need to ask a number of questions when a new customer comes to you:

- Why is this customer opening an account with us?

- Have they finally been worn down by our dynamic sales team?

- Were they unhappy with delivery service levels or pricing structure of their previous supplier?

- Or are they coming to us because their credit is on hold elsewhere?

5. Failing to chase overdue monies promptly and regularly

Having a robust and rigid control policy in place is essential to successful debt recovery. Failings in this area are more commonplace in smaller companies where the focus of the business owner is on the day to day running of the business, and the onus is to chase monies “only when the cash is needed”. Often companies are reluctant to chase customers and risk jeopardising a good relationship. Remember – Credit is not a right, it’s a privilege. To abuse credit terms puts them in the wrong – not you.

6. Be prepared to turn down potential write-offs

“A sale is not a sale until its paid for” The credit management team is often at loggerheads with the sales team. SME’s all take calculated customer credit risks, weigh up the potential profitable return vs potential loss. There is no point in being turnover rich and profit poor, or having lots of credit notes and write-offs. Every day debt claims for huge sums that end up as write-offs are brought to solicitors and debt recovery agencies by client-chasing customers with all the warning signs there including CCJ’s. How can this happen? The answer is generally supplier ignorance and incompetency, maybe by not taking out a credit report, or setting up adequate credit management systems, you should always pre-check and then continue to monitor new and existing customers. This can be a hard and expensive lesson to learn, address it properly now: keep an eye on new orders, are they profitable, and not being dispatched to those unable to pay?; Be prepared to turn down new credit account applications from companies that may not get credit elsewhere-offer them pro-forma, they maybe used to it ; Be prepared to withdraw/reduce credit facilities to established customers should their credit rating start to sink, or if you are alerted to new detrimental information about them i.e. CCJ’s. It’s the first thing the bank would do.

7. Know your customer - before, during and after

Managing a relationship with your customer can help reduce write-offs. Successful businesses that survive the tough times have robust procedures in place, always start with a prospect check, there’s little point in a salesman chasing 50 leads only to find out that none pass the company policy opening procedures, a quick prospect check will save valuable time and give a good indication of whether that customer will be a liability or a great opportunity. Having a comprehensive credit account application form – with separate ones for Ltd Companies, Sole Traders and Partnerships and asks the right questions is essential should problems arise in the future.

Conclusion

Get all these in line and your B2B cashflow should run smoothly, the slightest chink in your armour though will give a buyer an excuse not to pay your invoice. I’m always happy to offer advice on B2B overdue invoice recovery. Invoices of below £3,000 we recover a zero cost to you, over £3,000 we charge a subsidised rate of just 2% often recovering your money in under a week.

Blog by Direct Route

Join Our FREE Business Owners Hub

Get access to our latest blogs, PDF downloads and updates.